Are You Prepared For The Coming Economic Collapse And The Next Great Depression?

So what exactly is an “Economic Collapse”?

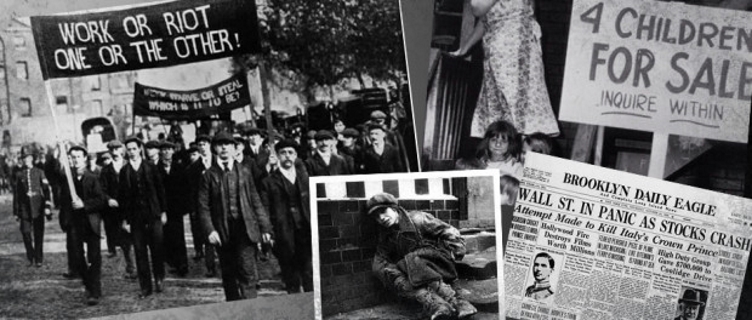

In proper context, it would be a complete breakdown of our national and regional (more than likely global) economies. It is basically a severe economic depression, where an economy is in complete distress for years or possibly even decades. The Great Depression is a decent example of an economic collapse. In 1929, the stock market crashed after amazing growth (and manipulation) and it destroyed the economy. This brought about unemployment to the tune of 24% – possibly 25%, high levels of poverty and it lasted for many years. You can always pin-point an economic collapse by a few specific factors. These events are characterized by extremely high unemployment, excessively high poverty levels, and bouts of civil unrest. The scary element of this is the fact that desperate people do desperate things.

Causes of these events range from market manipulation, hyperinflation, deflation, bubbles bursting, stagflation and basic financial-market crashes. Of course, these headings have their own extensive lists of causing factors such as out of control debt and currency devaluation. Sometimes, a simple drop in consumer confidence can get the ball rolling. Of course, we are already witnessing much of this and anyone paying even the slightest bit of attention has undoubtedly heard these terms as of late.

There are some that believe that government intervention may be necessary to bring an economy back from collapse. Some believe that government intervention is the last thing that should be done. Still, some believe that an economic upheaval is only corrected after the war that inevitably follows. After the Great Depression for example, the government created many programs building roads, buildings, bridges, etc., to get people working while also building national infrastructure. Did this fix the economy? What we know for sure is that it brought about substantially larger government in the end, which in many ways just perpetuated the cycle. Then what happened? World War II and the end of the Depression. Maybe they are all right.

As you can see, it is not hard to imagine why or how we got here or where we might be heading. It’s also not hard to imagine why people are starting to see things the way I do. After all, retail sales continue to fall, retail closures are happening in droves, layoffs are ever-present with more on the way, and home ownership continues to decline. Oddly enough, the businesses that appear to be doing alright are the ones that cater to the lower income families. In fact, let’s get a little more in depth on this.

What we all need to understand is that our economy is not just in decline, but it is already at Great Depression levels. Understand that only 86 million Americans are actually working. This includes both part-time and full time workers. The remaining 245 Million are unemployed, too young or too old to work. Meanwhile, the IRS is pulling in record levels of taxation, which means that the 86 million are actually pulling in less and less. Furthermore, well over 161 million—are now getting government subsidies. This means that well over 50 percent of U.S. households now receive benefits from the government. This is getting worse by the day.

But the government is trying to sell people on the idea that we are in some massive economic recovery. This is not true. The problem is that the government is messing with the numbers and not providing the real picture. This is necessary for them though, because they need you to believe things are getting better, so you will go out and spend what little money you have. I would not recommend this by the way – unless of course it is to buy something to better prepare you for what is about to occur.

For example: the government is trying to tell you that the unemployment rate is 5.6%; lower than it was before the economic crisis of 2008. This is highly inaccurate though. What they are showing you is something called the U-3 number, and this number excludes quite a few people who really need to be counted. Bill Clinton changed the way government tracks unemployment back in the mid-1990’s. However, if you were to track unemployment like they did back during the Great Depression, you would see that unemployment rate is actually somewhere around 23.2%. Please note how drastically close that number is to the worst part of the Great Depression which again, was 24%. Now understand that we are just getting started in regard to our problems. This number stands to get much higher very soon for a host of different reasons.

Even Gallop recently reported how much of a lie the 5.6% number is. As Jim Clifton states: “The official unemployment rate, which cruelly overlooks the suffering of the long-term and often permanently unemployed as well as the depressingly underemployed, amounts to a Big Lie”. The big question on everyone’s mind is “where are the food lines then?” Well, during the Great Depression, there was no such thing as entitlements such as Welfare. That means today, soup lines are at the mailbox. Our biggest problems are hidden on the sidewalk. It gets worse.

The mainstream media has reported that food prices are on the rise. Some blame this on the idea that we have hit peak food production. Still, food prices have increased over 18.1% on average. Meanwhile, household incomes have only increased by roughly 1% during that same time; that is… for those who are lucky enough to still have a job. In other words, the cost of living is going up, but the money being received is not. Now, let’s add on the unbelievable costs associated with the new healthcare regulations which are actually doubling a family’s health care costs while also adding to the national debt. Less dollars to spend means less opportunity to stimulate economic growth. Not that it matters anyway, because everyone has been trained to buy foreign goods which does little to stimulate our economy anyway.

All of this… while the government was engaged in something called Quantitative Easing, which has the sole purpose of pumping money into the economy by the billions. Did it or does it help? Well, I can say it probably prolonged the inevitable, but the numbers continue to worsen, so obviously not. It did however; add to the national debt, which just makes the problem worse. Now, experts are coming out to tell people just how bad things are becoming.

For instance, Robert Wiedemer, Managing Director of MacroView Investment Management, who holds an MBA from the University of Wisconsin–Madison, and is the best-selling author of “The Aftershock Investor,” says the so-called recovery is “100 percent fake.” He was one of the few economists who correctly predicted the collapse of the U.S. housing market, equity markets, and consumer spending that almost sank the United States during the “Great Recession” of 2008. Recently, he predicted that the coming market crash will result in a 90% stock market drop, 50% unemployment, and 100% annual inflation starting this year (2015). Unfortunately, there is a lot of evidence to back this up.

The stock market volume is actually drastically low. And it doesn’t really matter anyway because stocks are actually priced 53% higher than their 10-year average. This is an obvious problem for investors. But even when you look at activity within the market, you see horrible trends. When the stock market advances drastically, there is usually a snap-back effect. For example: when we have seen advances that were over 100%, we very quickly saw a crash of roughly 50%. Can you guess what we recently saw? Yup! We just finished a rally topping 100% on very low volume, so another drastic market correction is probable, only now because of the low volume, this one might hurt just a bit.

Of course, if this is all true, then government would be preparing right? They are! States such as South Dakota (just for example) are beginning to create policy accordingly. In fact, Republican Rep. Steve Hickey of South Dakota recently presented a bill to create an Economic Contingencies Work Group to prepare for a coming crisis, saying that significant uncertainty in the national and global economy means the state should start contingency planning to respond to a financial disaster.

But it’s not just a US problem. This thing is global, which further complicates the picture and darkens up the effect. To break this down as simple as I can, global debt has risen a massive $57 trillion (more than 25%) since the crisis of 2008. It’s getting worse for a lot of different reasons, but also because of the nation’s now trying their hand at their own QE – Quantitative Easing – schemes. The point is that there is little (if any) real evidence to suggest that things are getting better. In fact, just the opposite is true.

It has been said that the United States and Europe overall, are in a debt-fueled deflation which is spiraling out of control. And with interest rates at next to nothing, it means there is little (if any) room left to wiggle. Now factor in the drastic reduction in retail sales and the dramatic reduction in manufacturing and exports out of China, we begin to see a much bigger and darker picture. Things are slowing down at a dramatic pace. Of course, this affects China substantially and they are seeing the signs as well – and preparing.

But everyone has their eyes on the Baltic Dry Index (BDI). So far, it is considered the best measure of global economic health. Unfortunately, it is showing us bad news as well. The BDI is used by economists as a leading global economic indicator because it predicts future economic activity. The bad news is that the BDI is currently telling economists that we are headed for a depression that will make 1929 look like a cake walk. In fact, some are predicting this crisis to begin within days or weeks. Others say months. Regardless, I don’t know if there is really a difference, because soon enough is bad enough for me.

Meanwhile, there are nations such as Spain and Ireland, whose economy are on the verge of collapse. Russia seems to be proactively recruiting nations (such as Greece for example) to fall under their sphere of influence which is also a bad sign. It’s actually not a bad deal for those nations though, because Russia has the energy, and will soon have the BRICS bank. But factor in Germany, France and Italy chumming it up with Russia and it’s not hard to see the EU collapsing right alongside the global economies, or even being the cause.

Unfortunately I could go on and on. The sad truth is that it seems we have come to the end of our economic rope – and history appears to be repeating itself with mathematical precision. I have spent the better half of the last decade warning people of the indicators, and thankfully, a few have listened. The cycle (economic upheaval) is about to apex, but that also means that the sister cycle is about to begin and the next 10 years will be very turbulent.(source)

FINAL WARNING AMERICA, THE HARBINGER 100% CHANCE DOLLAR COLLAPSE2015

Hope for the best, but prepare for the worst.

This is a good motto to live by, despite how you think about things.

Individuals can still hope for the best (that things can and will eventually work out), but what good is your prosperity going to do if you don’t have anything to eat or a safe place to hang out for an extended period of time?

Why not prepare while you still can — when things are readily available and can still be purchased at cheap prices? The coming hyper-inflation will make any such purchases beforehand look very intelligent…

To prepare for the worst, you need a plan. Why are most people so against doing basic preparations that could be the difference on how they survive — or whether they survive?

History shows time and again that those who prepare always fare better than those who did not.

Having a plan and being determined to act on that plan will always be the best way to handle any contingencies, should they occur.

After disaster strikes, your mind is going to be racing around like a car on a race track. Preplanning and having a written set of measures to take will make someone’s life go much smoother when the SHTF.

Survival MD (Best Post Collapse First Aid Survival Guide Ever)

Backyard Innovator (A Self Sustaining Source Of Fresh Meat,Vegetables And Clean Drinking Water)

Blackout USA (EMP survival and preparedness)

Conquering the coming collapse (Financial advice and preparedness )

Liberty Generator (Build and make your own energy source)

Backyard Liberty (Easy and cheap DIY Aquaponic system to grow your organic and living food bank)

Bullet Proof Home (A Prepper’s Guide in Safeguarding a Home )

Family Self Defense (Best Self Defense Strategies For You And Your Family)

Sold Out After Crisis (Best 37 Items To Hoard For A Long Term Crisis)

Survive The End Days (Biggest Cover Up Of Our President)

Drought USA(Discover The Amazing Device That Turns Air Into Water)