U.S. National Debt

When the government spends more than it collects, the result is additional debt. From the signing of the Declaration of Independence in 1776 until 2008, the U.S. accumulated slightly over $10 trillion in federal debt. In the past seven years, the debt has nearly doubled to more than $18 trillion. By the year 2021, it is projected to exceed $20.3 trillion. When interest rates rise, the impact will be felt by the federal government as well as everyday Americans. First, it will increase the government’s cost of borrowing, which will cause the debt to rise even faster. It’s entirely possible that even a modest rise in interest rates could cause the debt to spiral out of control.

This is because Washington is heavily dependent on borrowing to operate. Next, it will be much more difficult to expand or even maintain the welfare state. This fact alone will lead to mass riots as individuals who are dependent on a government check will take to the streets in protest. Also, the U.S. would have a more difficult time funding its presence (i.e. military bases) around the world. This would lead to a less stable socio-political environment and an uptick in radical behavior. Plus, a shortage in government revenue could result in a rather large tax increase and the eventual demise of the middle class. Finally, and as we’ve already seen, the federal government may decide to target 401ks and IRAs as a source of additional revenue. This could take the form of a tax or fee of some sort. Mr. Paul also mentioned the possibility of a tax on regular savings and other assets. If the government finds itself in a tight situation, as we’ve witnessed in the recent past, the potential intrusion could be severe.

Is the U.S. Losing its Stature?

In the post WWII era, the U.S. dollar has been the global reserve currency. Prior to that, the British Pound filled this role. Recently, China has increased its trading with Germany, India, and others, excluding the dollar as the reserve currency. It seems the world is slowly transitioning away from the dollar. If this continues, the U.S. could lose its position as the world’s reserve currency. This would have numerous ramifications. A discussion on that is beyond the scope of this article. Mr. Paul also stated that 10 countries have already signed a document to begin phasing out the dollar as the basis of trade. Even the IMF has proposed a new world reserve currency system. The days of the U.S. dollar as the world’s reserve currency may well be numbered.

The tech sectors is now getting hit with layoffs. The Dallas Fed survey is at a 6 year low and crashing. Manufacturing in a decline which is signalling a major depression coming soon. The East know the West is now bankrupt and they are preparing and waiting patiently for it to be complete. Norway’s biggest bank is now pushing a cashless society. The house of Saud will most likely contribute to the collapse of the global economy.

- Faced with a sovereign debt crisis, the European Central Bank launched its own “quantitative easing” program and pushed short-term interest rates below zero.

- The Bank of Japan tried to jolt its economy out of two “lost decades” with a multi-trillion yen stimulus program.

- China’s economic growth began slowing, causing the People’s Bank of China to loosen its currency’s dollar trading band.

- A plunge in energy and commodity prices threatened to destabilize emerging-market nations (like Brazil, Russia, Malaysia, Venezuela, Iraq, and even Saudi Arabia), which are heavily reliant on revenues from resources.

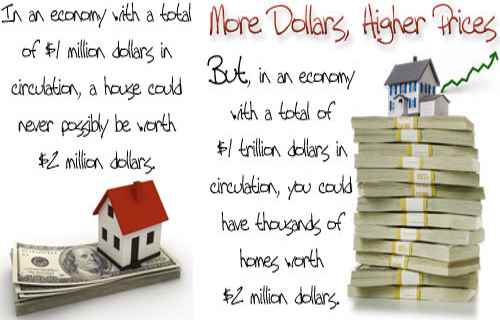

Some argue that the U.S. economy is on the mends and the stock market is near record highs. Therefore, things can’t be all that bad. While there is truth in this, according to Paul, stocks have risen due to Fed policy and political leaders. He also stated that printing money has never solved this type of problem….ever! He cited Germany, Russia, Argentina, Brazil, Chile, Japan, China, Ukraine, Italy, Ireland, Portugal, and Spain as examples of countries that had similar problems to the U.S. and yet none of them was able to use the printing press to escape their problem.

Will the U.S. follow the path suggested by former Congressman, Ron Paul?

This collapse will be global and it will bring down not only the dollar but all other fiat currencies,as they are fundamentally no different. The collapse of currencies will lead to the collapse of ALL paper assets. The repercussions to this will have incredible results worldwide and each economists contend that The dollar collapse And The economic collapse will be on December

One major concern that Washington had was regarding the potential shift in global demand for the U.S. dollar. With the dollar no longer convertible into gold, would demand for the dollar by foreign nations remain the same, or would it fall?

The second concern had to do with America’s extravagant spending habits. Under the international gold standard of Bretton Woods, foreign nations gladly held U.S. debt securities, as they were denominated in gold-backed U.S. dollars. Would foreign nations still be eager to hold America’s debts despite the fact that these debts were denominated in a fiat debt-based currency that was backed by nothing?

Against this precarious background, millions of Americans saw their own economy’s feeble growth and imagined that this economic tornado would hit the US next. The dollar was toast, they thought.

How to Protect Your Savings from Currency Volatility

How can you prepare for this uncertain future?

- Stay Liquid. Avoid tying up capital in investments that will be hard to exit. We are entering a time of unpredictable volatility. Stay in dollars, but be ready to “hedge” or shift direction if necessary.

- Minimize debt. Carrying a heavy debt load is the opposite of staying liquid. It ties you down and keeps you from capitalizing on opportunities. If you must borrow, try to do it in some currency other than the dollar. This will reduce your real repayment cost if the dollar continues to strengthen.

- Own Gold for Insurance. Gold has been the “currency of last resort” for decades. Unlike fiat currencies—the dollar and all others—it will hold somevalue indefinitely. Don’t invest in gold to the exclusion of other assets, but have some as an emergency reserve.

The following are items you are likely to be unable to acquire during the last five days before the collapse.

- Gold and Silver – Few people are likely to offer their gold or silver for sale, unless they are desperate for food.

- Guns (rifles, carbines, pistols, revolvers, shotguns) – Guns will be in short supply, as there will be a rush to stock up before the collapse. As a survival prepper, you should already be prepared with your defensive weapons battery. You should already be trained on the usage, cleaning, maintenance and minor repairs of your guns. You should already be aware of proper safety practices and the gun laws of your location.

- Ammunition – Expect all ammo to be bought out. Some localities my freeze the sale of guns and ammo, ahead of or during civil breakdown.

- Power generators – Will be sold out quickly, but believe this might be a waste of money. As fuel will become difficult to acquire, most power generators will go quiet within a month. If you do buy a power generator, choose one that supports multiple fuels, such as also alcohol, propane, natural gas, and diesel fuel. If you are able to generate your own pure alcohol or bio-diesel, you will have a great advantage. The better setup is a wood burning fireplace and wood burning cook stove in the kitchen, along with a sturdy back and sharp axe.

- Solar panels (and related long-term batteries) – If you have your own solar panel setup, and able to run your homestead and recharge small batteries from solar power, you will have an advantage. If you desire such a setup, you will need to have this well ahead of a collapse. After a collapse, be watchful for theft of solar panels. Solar panels will make your homestead a target for bad people.

Books can be your best pre-collapse investment.

Carnivore’s Bible (is a wellknown meat processor providing custom meat processing services locally andacross the state of Montana and more. Whether your needs are for domestic meator wild game meat processing)

The Lost Book of Remedies PDF ( contains a series of medicinal andherbal recipes to make home made remedies from medicinal plants and herbs.Chromic diseases and maladies can be overcome by taking the remediesoutlined in this book. The writer claims that his grandfather was taughtherbalism and healing whilst in active service during world war twoand that he has treated many soldiers with his home made cures. )

Easy Cellar(Info about building and managing your root cellar, plus printable plans. The book on building and using root cellars – The Complete Root Cellar Book.)

The Lost Ways (Learn the long forgotten secrets that helped our forefathers survive famines,wars,economic crisis and anything else life threw at them)

LOST WAYS 2 ( Wordof the day: Prepare! And do it the old fashion way, like our fore-fathers did it and succeed longbefore us,because what lies ahead of us will require all the help we can get. Watch this video and learn the 3 skills that ensured our ancestors survival in hard times offamine and war.)