The world economy has never faced a more perilous situation. While many have just started to debate whether a recession will start in 2019 or 2020, very few perceive the ’black hole’ the global economy is about to get sucked into. With the trade war between the US and China re-escalating once more, investors are again casting frightened glances at declining global trade volumes, which threaten to upend the global economy’s much-anticipated rebound and could even throw its decade-long expansion into doubt if the conflict spirals out of control .

What is a recession?

A recession is often defined as two consecutive quarters in which an economy shrinks. According to the century-old nonprofit National Bureau of Economic Research, a recession can be identified by clear signs and symptoms. The organization defines a recession as “a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.”

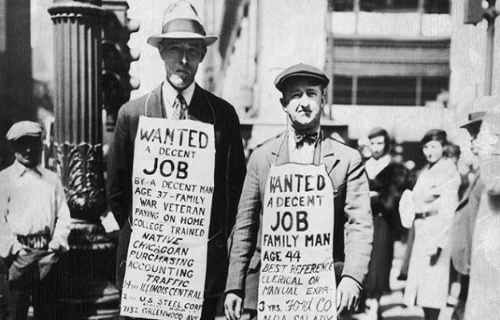

This definition makes clear that recessions are extremely disruptive to people’s daily lives and financial fortunes, causing everything from layoffs and unemployment to rising prices and shortages.

All of these effects were in evidence during the Great Recession of 2008, the worst economic downturn in living memory.

Some of these effects may show up in certain parts of the economy during what may be termed “mini recessions,” wherein economic growth slows but doesn’t entirely stagnate or reverse. In 2015-2016, for example, the U.S. economy went through this type of slowdown; with economic growth still positive and a falling unemployment rate on a national level, the period didn’t meet any usual definition of a recession, but the energy and agricultural sectors, and manufacturers who supply them, felt the pain as those particular industries struggled with a downturn.

So here are top 10 signs we are entering into an economic depression / recession .

1. Real Estate prices are dropping due to decreasing sales activity, in spite of historically low interest rates.

2. New Construction starts have been declining for 18+ months.

3. Historical glut of vacant commercial real estate.

4. Personal debt for Americans has now reached an all time high; $38,000 per American adult. How much more can they “borrow and spend” to keep the economy going?

5. Europe’s economic powerhouse Germany is now in a recession, which will lead to continued slump in the EU. The Great Depression began overseas when the credit bubble collapsed. We could see a similar scenario play out.

6. Currency Wars often lead to Trade Wars which often lead to shooting wars. We are now in the 2nd. phase … will we reach the disastrous 3rd. phase?

7. America hasn’t been this divided since the Civil War. Social chaos is not “good for business.”

8. Socialism is seriously being offered as an “alternative” socioeconomic” system. Millions of young people now completely support socialism.

9. Economies around the world are dumping the US Dollar and buying gold.

10. Pension Fund crisis , with the majority of pension funds are severely underfunded, putting millions of retired and soon to retire Americans at risk. Honestly, this isn’t Rocket science people. The Dow going up 10,000 points in 3 years with no substantial change in goods or services to justify it is all the evidence you need.

The market is going to crash hard! It will drop at least 9,000 points when it does. We have never left the systemic crisis.

The systemic crisis was triggered by the globalization process driven by corporate finance and global oligopolies with the support of central banks. It was an operation that devastated the entire West socially and economically, compromising the stability of the nations that compose it. A crazy and wrong idea, now we will have to manage the consequences. Blanket trade tariffs on all Chinese exports to US as introduced by Trump will produce a recession and hyper-inflation on a grand scale. Not helping the situation BOEING now stuck to the ground in terms of new aircraft sales for some time as the lawsuits fly.

Trump would like to tariff the European cars adding to the sense the American leader getting more desperate by the day. The need for US Iran war seems conjured up to promote Trump as the leader of the free world at war and confirming his credentials for the job. China knows that Trump is making every attempt to humiliate China and not aware that his wild west actions will have dire consequences for the world economy.

How China retaliates and takes aim at his populist base; the working-classes and farmers of America. Every president doubled the debt they inherited.They have all spent like drunkards , and kicked the can down the road. Except Trump He kicks it down Death Valley . The FED doesn’t pay a single cent for the money it creates. Yet, they charge everyone to borrow it. That is their bread and butter. During periods of expansion they always claim inflation is the reason they need to hike, but the fact of the matter is in a expanding economy more cash is needed to facilitate translations of the every increasing amount of goods being created and sold. They get away with it every time, and when they do it, it puts a cork in the expansion and is usually followed by a slow down.

The FED is your problem, because they want to skim their profits off the backs of everyone for a piece of paper that cost them nothing to make. Moreover, the fed is a private enterprise, and they make a profit, yet they are not taxed for the income they make. You can’t audit them. The USA is today the most indebted and INSOLVENT country in the history of the world and all of that debt is coming crashing down all over the place. The only question is why interest rates have not soared upwards across the board to default levels, but that is what is coming next as much of the country veers towards and to default. Americans need to wake up and smell the coffee.

Europe and America are broke and poor and no amount of money printing will save them. The “High IQ” elites allowed a foreign hostile nation (China) to bait them into moving their industrial base there and giving away their manufacturing secrets all in the name of more profits. The very thing that caused Europe and America to rise to the top of the world is what was given away. Now the Europeans and Americans have a greatly diminished industrial capacity, few natural resources and a population that believes that they are entitled to be the best paid people in the world.

This is why the Right Wing continues to gain popularity.The Americans and the europeans are scared that they will soon be living like the “Third Worlders” who they have been looking down on for years. The Chinese have never forgotten the 100 years of shame and are slowly tightening the noose around the necks of the Americans ,flooding them with fentanyl and slowly destroying their economies. When the fiat currency runs out (and it will soon).We will be among the poorest in the world .

How To Prepare For The 2020 Recession

Whether a downturn happens in the next year or not, it’s important to be prepared.

Being prepared for a recession essentially means being ready to care for yourself and your family financially if your current situation is forced to change. Here are some specific recommendations:

Build your emergency fund

The number one thing you can do to prepare yourself for the next downturn is to save up a substantial chunk of money to serve as an emergency fund. Experts recommend keeping 3-6 months of living expenses in a high-interest savings investment account. This money should be sacrosanct; only to be touched in the event of an unexpected emergency like losing your job or having your hours at work severely curtailed.

A recession can compound the difficulty of losing a job because not only are you out your usual income but a sluggish economy may make it hard for you to get hired again at a similar salary. When you do find new work, you may be forced to take a pay cut or work more hours for the same pay, which will result in financial pressure unless you have savings to make up the difference.

Homesteading is the only (legal) way I know of to become almost completely self-reliant from the food corporations, the utilities companies, the Government and Big Pharma… by harvesting hundreds upon hundreds of dolars of organic food year-round, and collecting thousands of gallons of crystal-clear drinking water for free…

To take back your health by growing your own groceries, and making your own food out of basic ingredients, such as cheese, bread and even chocolate to name a few…

Then you could stockpile the excess produce for dark days… (The shelf life of ingredients is longer than that of the resulting foods, anyway…) So while other preppers pay thousands for overpriced, highly-processed “emergency food”, you’ll build your survival stockpile for free…

It’ll be like having your own personal supermarket just a few feet away from you… Though not the kind that sells processed meat full of hormones and steroids, veggies full of pesticides that have absolutely no taste at all, not to mention and all the other junk full of preservatives…

Examine your expenses

Considering that an emergency fund will only go so far to support you in the event of a job loss or pay cut, it’s good to make sure you’re living as lean a lifestyle as possible before the worst actually happens.

Make it a habit to sit down with your family and examine your spending to find areas where you can tighten your belt. Some items that may be on the chopping block are eating out, expensive clothes or gifts, extra spending on hobbies, and vacations.

Pay down debt

Working to pay down debt when the economy is booming is like doing your future self a favor. You can start paying extra capital while things are good to pay your debts off faster. You could consolidate loans to get a lower average interest rate or enter credit counseling if your debt is a burden. Getting your debt payments under control is essential, since having good credit will help you weather future financial storms.

A popular way of paying down debt is the “debt snowball” method, which involves paying off your smallest loans first to give you some early wins that can motivate you to tackle your bigger loans. Another option is the “debt avalanche” method, which has you pay down your debts with the highest interest rate first, no matter its size, and work your way down to the lowest-interest loan.

Gain employment and side-hustle skills

One of the major concerns people have about recessions is the potential for job loss. Layoffs are common when the economy takes a nose-dive, and getting a new gig can be tricky when no one’s hiring. One good thing to do while the economy is healthy is to pick up some in-demand skills or credentials to make yourself more attractive on the market in case you need to look for a new job in a down economy.

Another option is to pursue skills that can be done as a freelancer so you’ll be able to find smaller jobs as a stopgap if your main income source dries up. Once you’ve got those skills, you can use them as a side hustle to earn extra income that you can stash away in your emergency fund or use to pay down more of your debt.

Set up access to additional credit

Along with recession-proofing your job skills, it can be a good idea to enhance your financial resources for potential future need. You can access additional credit through a home equity line of credit or some new credit cards with higher limits. Keep those resources open and don’t use them before you have to.

If you have credit card debt already, it is a better idea to pay those down as fast as you can to free up credit than to apply for new credit cards. Consolidating your credit card debt using a personal loan that allows it is another good way to increase credit flexibility while also reducing your average interest rate.

Over 236,000 people in 160 countries have already used this Device successfully!

Protect your home with a new fully automatic standby generator. Maintain your security system, lighting and air conditioning to keep your family or business safe and comfortable through any power outage

Enjoy the total peace of mind that comes with knowing you have a constant and reliable power supply for your home or business in with a standby generator from Alternate Power Solutions. From everyday necessities like heating, cooling, refrigeration and lights, to daily essentials like cooking, laundry or kids bath times. Power outages are occurring more frequently than ever and lasting longer with devastating effects.

Stand up to unpredictable weather and unforeseen outages with the most trusted name in residential standby power with backup generators for homes. If the power ever goes out, your General standby generator goes on – automatically – protecting you and your home 24/7.

Books can be your best pre-collapse investment.

Carnivore’s Bible (is a wellknown meat processor providing custom meat processing services locally andacross the state of Montana and more. Whether your needs are for domestic meator wild game meat processing)

The Lost Book of Remedies PDF ( contains a series of medicinal andherbal recipes to make home made remedies from medicinal plants and herbs.Chromic diseases and maladies can be overcome by taking the remediesoutlined in this book. The writer claims that his grandfather was taughtherbalism and healing whilst in active service during world war twoand that he has treated many soldiers with his home made cures. )

Easy Cellar(Info about building and managing your root cellar, plus printable plans. The book on building and using root cellars – The Complete Root Cellar Book.)

The Lost Ways (Learn the long forgotten secrets that helped our forefathers survive famines,wars,economic crisis and anything else life threw at them)

LOST WAYS 2 ( Wordof the day: Prepare! And do it the old fashion way, like our fore-fathers did it and succeed longbefore us,because what lies ahead of us will require all the help we can get. Watch this video and learn the 3 skills that ensured our ancestors survival in hard times offamine and war.)

Survival MD (Best Post Collapse First Aid Survival Guide Ever)

Conquering the coming collapse (Financial advice and preparedness )

Liberty Generator (Build and make your own energy source)

Backyard Liberty (Easy and cheap DIY Aquaponic system to grow your organic and living food bank)

Bullet Proof Home (A Prepper’s Guide in Safeguarding a Home )

Family Self Defense (Best Self Defense Strategies For You And Your Family)

Survive Any Crisis (Best Items To Hoard For A Long Term Crisis)

Survive The End Days(Biggest Cover Up Of Our President)